Health365.sg held its inaugural public webinar LET’S TALK on “Understanding The Cost Of Cancer Drug Treatment And How To Manage The Financial Impact Of Cancer” on 30 Sep 22, with speakers Dr Wong Siew Wei and Ms Pamela Chong. The webinar was sponsored by TN Advisory Group (a group of representatives from Legacy FA Pte Ltd).

Dr Wong is a senior consultant, medical oncologist from Parkway Cancer Centre, and a member of our Expert Advisory Board. Dr Wong’s areas of expertise and interest are in prostate, kidney, bladder, upper gastrointestinal and lung cancers. Ms Pamela Chong is an Associate Manager with TN Advisory Group. She is a certified Chartered Financial Consultant ChFC®️/S and a Million Dollar Round Table MDRT®️practitioner in the Financial Planning industry for 16 years.

Understanding The Cost Of Cancer Drug Treatment in Singapore

During the webinar, Dr Wong Siew Wei explained the recent restructuring of the financing for cancer drug treatments by the Ministry of Health was aimed at keeping cancer treatment costs and insurance premiums affordable for Singapore Residents in the long term. Cancer drugs that are deemed clinically proven and cost-effective are included into Cancer Drug List after major price negotiation. From September 2022, only cancer drugs that are included in the Cancer Drug List (CDL) are claimable under MediShield Life and Medisave. From April 2023 onwards, new / renewed Integrated Shield (IP) plans can only cover for drugs that are included in Cancer Drug List. At the same time, more drugs are included in Medication Assistance Fund list to provide better coverage for more Singaporeans, subject to means testing.

Funding For Cancer Drug Treatment

Dr Wong explained further the tiers of funding applicable for cancer drug treatment in Singapore:

- Individual drug assistance program

- These are selective support of cancer drug cost targeted at patients without Integrated Shield plans, offered by pharmaceutical companies.

- Standard Drug List (SDL) or Medication Assistance Fund (MAF)

- Drugs that are on SDL or MAF are subsidised for eligible patients in public hospitals in Singapore, subject to means testing. Funding support under MAF is extended to include those with monthly per capital household income of up to $6,500 for Singapore citizens (up from $2,800 previously).

- MediShield Life

- Claim limit is changed from $3,000 per month (independent of cancer treatment drugs used) to $200 – $9,600 per month (depending on the drugs used). Treatment must be as indicated in the Cancer Drug List. Where combination cancer drug therapies are required, patients will be only able to claim for the higher-cost drug on the Cancer Drug List.

- Integrated Shield Plan +/- Rider

- Cancer Drug List restriction will apply from Apr 23 for standard IP plans. Insurance companies may offer coverage for drugs not listed in Cancer Drug List in the future under Rider plans, but premiums will likely be higher.

- MediSave

- Most treatment indication will have lower Medisave limit claim from $1,200 per month to $600 per month

- Out of pocket cash

How Are Drugs Determined for Inclusion In The Cancer Drug List?

To have specific drug treatments included in the Cancer Drug List, the treatments must be both clinically proven and also cost-effective. Pharmaceutical companies will apply to the Health Sciences Authority for assessment of the treatment’s clinical efficacy and safety, and to the Agency for Care Effectiveness for assessment of the treatments cost effectiveness (i.e. is the price reasonable compared to the benefit). The evaluation is a complex process, and only when both criteria are met will the treatment be approved for the Cancer Drug List.

What Is “Off-Label” Cancer Drug Treatment?

On off-label drug treatment, Dr Wong explain that these referred to use of a drug for a different purpose than what was approved by the regulatory body. This practice is called ‘off-label’ because the drug is being used in a way not described on its package insert (i.e. its label). In the Singapore context, drugs can be “off-label” because of:

- Lack of approval for the specific indication (due to rarity of disease or lack of clinical trial data)

- Not cost-effective enough to be included in the Cancer Drug List or the pharmaceutical companies did not apply for Cancer Drug List inclusion

- Delay in approval by the HSA and / or Cancer Drug List due to very recent data publication.

“Off-label” drugs treatments are not eligible for Medication Assistance Fund, MediShield Life, MediSave, or standard IP coverage.

[Note: Opinions expressed during the webinar are Dr Wong’s personal interpretation of the general landscape of cancer drug funding in Singapore and does not represent the view of his company or his affiliated hospitals. New indications may be added to the current Cancer Drug List.]

How To Manage The Financial Impact Of Cancer

Ms Pamela Chong presented on how we can plan our finances to prepare against the financial impact should cancer strike.

Integrated Shield Plans

Ms Chong started by clarifying the misconception that when a person upgrades to IP Plans, his Medishield Life no longer exist. In fact, IP plans are made up of 2 components – MediShield Life, and additional private insurance coverage. MediShield Life forms the base of all IP plans. It provides cover up to B2/ C Wards in public hospitals. On the other hand, IP plans provide for the additional cost of treatment at private hospitals, or at B1 and above wards in public hospitals. From Apr 23 onwards, IP plans will reimburse the expenses for only treatments that are on the Cancer Drug List.

Contingency Plans In Case Cancer Strikes

In the event of cancer, our income may be affected, but we would still need to provide for expenses in a number of areas, such as basic necessities, family expenses, transport expenses, alternative treatment expenses, and potentially for the cost of off-label cancer drug treatments too.

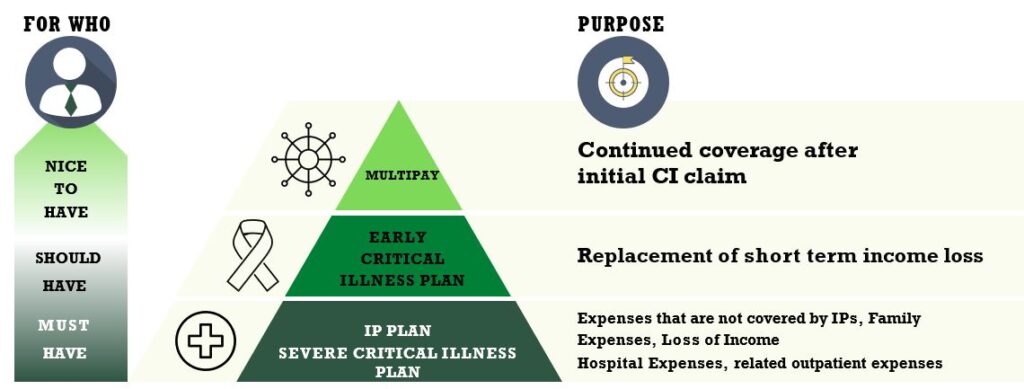

To provide for such contingencies, people can fall back on 2 types of insurance plans – IP plans and Critical Illness plans.

IP plans provide support on a reimbursement basis and can be used to cover inpatient treatments, selective outpatient treatments, and pre-medical and post-medical bills. On the other hand, Critical Illness plans pay out on a contractual basis, and can be used to cover the gap for off-label drug treatments, and for income replacement. These policies may be lump-sum single payout, or they may provide continuous coverage with multiple payouts.

The following diagram illustrates the Pyramid of Hope – a tiering of the different types of insurance plans in Singapore that we can get, from the “must haves” (namely IP plan and severe Critical Illness plan), the “should haves”, and finally, the “nice to haves”.

Ms Chong explained that people in different stages of life have differ concerns, and hence priorities in financial planning should be tailored to match the concerns.

Contingency Against The Cost of Cancer – TN Advisory Group Can Assist With Your Financial Planning

If you would like to consult with an experience financial advisor to plan out your protection against the cost of cancer treatment in Singapore, you can arrange for an appointment with TN Advisory Group using their contact form here. Quote the promo code “TN365” and receive a meet up gift (Yuan Skincare and Soap set, while stocks lasts) and a complimentary portfolio evaluation of 20 mins (no product purchase required).

TN Advisory Group is a group of representatives from Legacy FA Pte Ltd. At TN Advisory Group, they believe that financial planning is an intricate process that requires a sincere listening ear, an empathetic heart, and a relentless commitment towards improving the financial wellness of the lives they touch. Their team of experienced financial consultants will help to ensure your portfolio remains relevant in our ever-changing world, and that every purchase fits in the grand picture of your financial blueprint.

TN Advisory Group is the sponsor of this webinar.

[Note: Views expressed by Ms Pamela Chong during the webinar does not necessarily reflect the views of Legacy FA Pte Ltd. They do not should not be construed as an offer or inducement to sell, or a solicitation of an offer to buy, sell or subscribe for any investment or life insurance product or the giving of advice in any jurisdiction. The presentation is meant for informational / educational purposes only.]

Lifestage Financial Planning

Click below for a more detailed summary of Ms Pamela Chong’s explanation on how our financial priorities are affected by which stage of life we are at.

Protect against cancer, cardiovascular disease, and other chronic diseases with regular health screening. Compare and shop for health screenings from Singapore and regional healthcare providers at a single convenient platform - shop.health365.sg

This article is informative only and is not intended to be a substitute for professional medical advice, diagnosis, or treatment, and should never be relied upon for specific medical advice.